Ultima Wealth Assurance

About Product

Do you desire an effective solution financial planning for the future?

With the Ultima Wealth Assurance life insurance product, find a convenient way by paying one time Single Premium for protection along with long-term potential investment. You are also have piece of mind in planning future finances.

Product Highlights

Premium allocation up to 97%(1) for potential investment in US Dollar.

No fee for investment value withdrawal

with no bid/offer spread unit price.(2).

POLICY GUARANTEE ACCEPTANCE

up to sum assured USD50,000.(3).

OPTIMAL INVESTMENT OPPORTUNITIES

in Indonesia and global market.

(1) Investment allocation 95% of Single Basic Premium and 97% of Single Top Up Premium.

(2) Using one price for unit bid and offer.

(3) Based on terms & condition in Policy.

Product Benefits

Protection Benefit

Life Risk

Death benefit due to non accident or accident before 75 years old.

Benefit

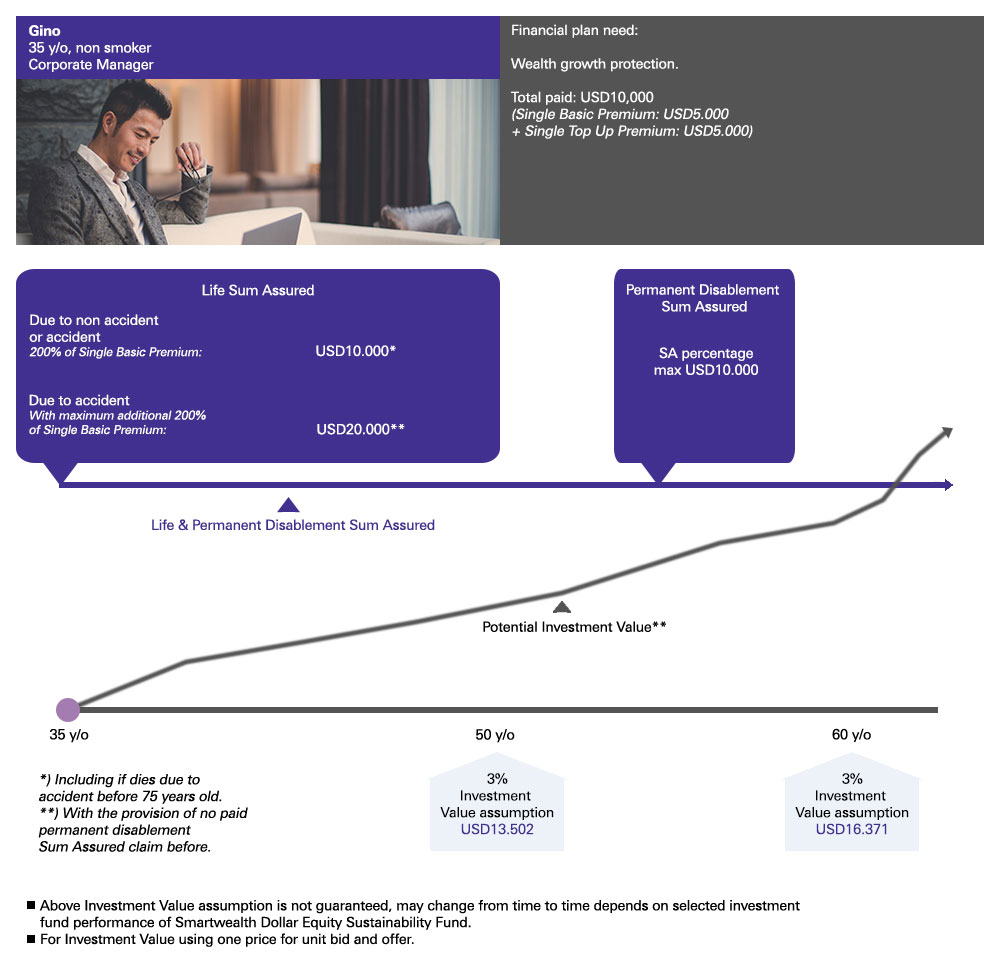

Life Sum Assured 200% of Single Basic Premium + potential Investment Value(1).

Death benefit due to accident before 66 years old.

Life Sum Assured with maximum additional 200%(2) of Single Basic Premium + Potential Investment Value(1).

Partial / total permanent disablement due to accident before 66 years old.

Permanent disablement Sum Assured in percentage(3) up to maximum 200% of Single Basic Premium.

(1) Investment Value assumption is not guaranteed, depends on selected investment fund performance.

(2) With the provision of no paid permanent disablement Sum Assured claim before.

(3) Decrease death benefit due to accident if happens later.

Investment Benefit

- Single Basic Premium allocation

95%(1)

in investment

- Single Top Up Premium allocation

97%(1)

in investment

- Maturity benefit: Potential Investment Value(2).

- Potential Investment Value(2) can be withdrawn based on needs.

(1) Acquisition cost amounted 5% for Single Basic Premium and 3% for Single Top Up Premium.

(2) Investment Value assumption is not guaranteed, depends on selected investment fund performance.

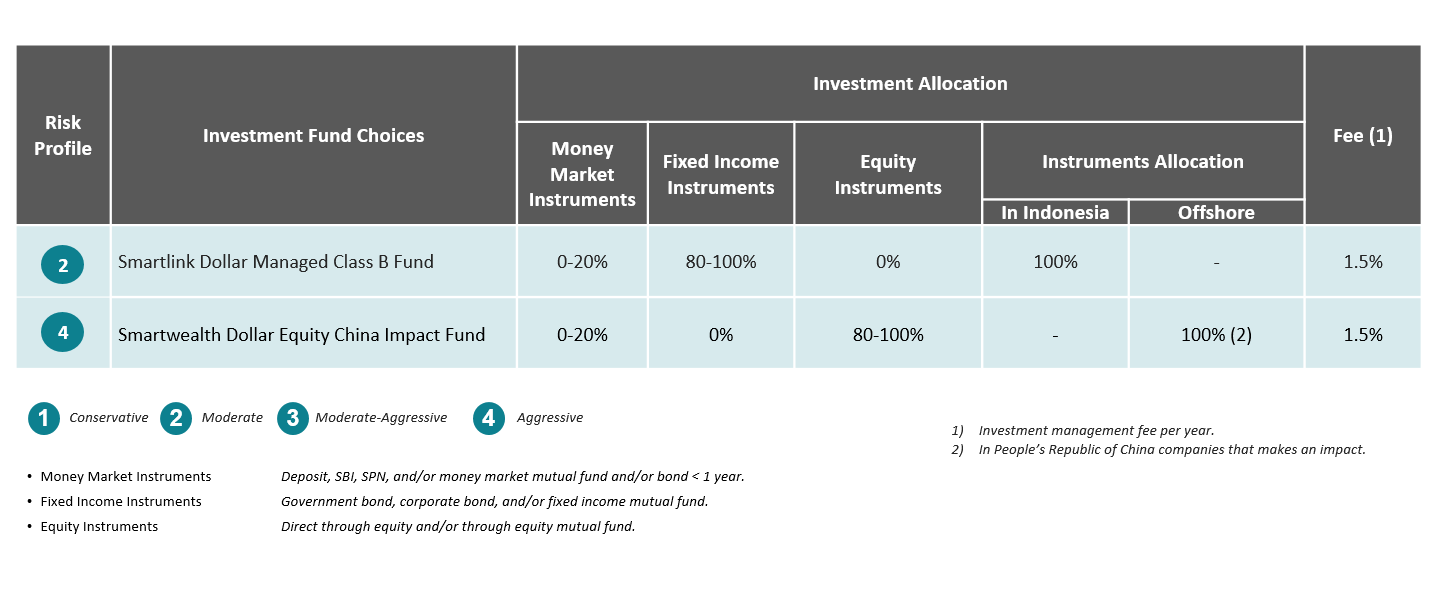

Investment Fund Options

Benefits Illustration

Product Risk Information

Investments in unit link insurance involve market, interest rate, liquidity, credit and other risks, including possible loss of principal amount invested. Investors must read and understand the Product Feature Document, Statement Form, Third Party Unit Link Insurance Product Terms and Conditions, marketing brochure, documents and other related literatures for risk factors, fees and other details before investing in unit link insurance. Past performance does not indicate future performance.

- Reduced Risk Value Units Accepted by Financier or the Net Asset Value (NAV)

Risk caused by falling prices of investment securities can reduce the Net Asset Value per unit. - The market risk of stocks or bonds

Fluctuations in stock or bond prices as an instrument of investment asset that could be affected by the performance of the company from issuing shares or bonds that will have an impact on the performance of managed funds. - Liquidity Risk

Withdrawal value (withdrawal / surrender) depends on the liquidity of the portfolio and the number of withdrawals. If at the same time, most or all Unit holders perform withdrawal which there is no liquidity in the market, then this may lead to decrease in the net asset value because of the effects of the portfolio should be sold into the market in large numbers simultaneously, so that it can lead to decline in value of securities in the portfolio. - Risk of Default

Risk in which bond issuers are unable to fulfill their obligation to pay back the issued bonds. This will impact the overall performance of managed funds - Risk of Counterparty Insurer

Risks where the counterparty insurer cannot fulfill its obligations. Counterparties include, but are not limited to issuers, brokers, investment managers, custodian banks and distribution partners who have been appointed by the insurer. - Risk of Economic and Political Change

Changes in economic conditions and political stability in Indonesia can affect the performance of companies, both listed on the stock exchanges and companies that issue money market instruments and bonds, which will indirectly affect the performance of the value of securities in the fund management company that issue the fund. - Risk of Interest Rate

Changes in interest rates either increase or decrease will affect the price of money market instruments and can affect the fund performance. - Cancellation Risk

If the customer sells / unfreezes / liquidates products before the due date, the customer will receive the investment value which is calculated based on the prevailing unit price after deducting other expenses. - Risk of Foreign Currency Exchange Rate

Exchange risk Foreign currency is a form of risk arising from changes in the exchange rate of a currency against another currency at the time of the transaction. - Risk of client's expectations to Overseas Investment

Strategy of investing overseas, although not necessarily provide diversification effects will provide better performance than investing in domestic investment where it is possible to experience losses. which is caused by risks related to political and economic condition, tax regulation, and other prevailing regulations in that country.

Terms & Conditions

- Insured entry age:

- Life protection period due to non accident or accident: 18 - 70 years old (the nearest birthday).

- Life & permanent disablement protection due to accident: 18 - 64 years old (the nearest birthday).

- Protection period:

- Life protection period due to non accident or accident before 75 years old.

- Life & permanent disablement protection due to accident before 66 years old.

- Minimum Total Single Premium USD10.000, consist of:

Single Basic Premium:- Minimum: USD5.000.

- Maximum: USD25.000.

- Minimum first Single Top Up Premium: USD5.000.

- No maximum amount.*

- For the next minimum Single Top Up Premium: USD500.

- Underwriting: Guaranteed Acceptance* with no health declaration or medical questioner.

*) For Life Sum Assured up to maximum USD50.000 per Insured, accumulated with the same guaranteed acceptance Policy in Allianz under the same Insured name. - Protection benefit exception available based on terms & conditions in Policy.

Tentang HSBC

Perbankan

Wealth Management

Informasi Penting

- Privasi dan Keamanan

- Ketentuan Penggunaan

- Kebijakan Hyperlink

- Keamanan Online

- Diterbitkan oleh PT Bank HSBC Indonesia yang terdaftar dan diawasi oleh Otoritas Jasa Keuangan (OJK).

- This product is an insurance product issued by PT Asuransi Allianz Life Indonesia. This product is It is not guaranteed by the bank and is not covered by the government deposit guarantee program (Lembaga Penjaminan Simpanan).

Bank only assumes the limited role of transmitting the information from the insurance company of the products to customers; or to provide access for insurance companies to offer insurance products to its customers. Insurance is not a bank product.